One of the best ways to make money is to invest it in the right manner and at the right time in the stock market. Do you think stock advisor are of great help? Do they give better market advice?

Stock investing at the right stock price is surely the most sought-after way of making profits in a short period through growth stocks. Out of all the picks, the most authentic and logical ones come from David Gardner.

The founder of motley fool stock advisor, one of the best investing advising companies out there, and the market leader, David’s stock picks are rightfully quite beneficial.

His picks ensure that the portfolio of his clients spreads across various sectors, as it helps limit down the risk and instability.

The stock advisor and rule come in form of newsletters, books, etc.

What Are David Gardner Stock Picks?

David Garnder stock picks, in simple terms, the analysis of the stocks that are perceived to bring good returns in the future.

It is a systematic method of inspection, made by David Gardner, who offers his clients a way to manage their portfolio in the most secure manner possible.

David, the co-owner and founder of Motley fool, is a Stock Advisor, who is surely one of the most trustable ones out there.

This stock picker is well aware of the active management of stocks, considering their share price and the trend in financial markets. David, along with his brother Tom, had started the company, motley fool.

Initially considered as a small scale enterprise, it soon reached great heights of success.

They offer stock advisor service by offering stock-picking advice to the clients.

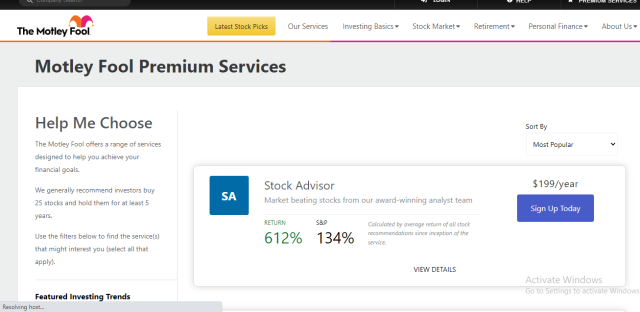

The Success of Motley Fool:

CLICK HERE TO READ MORE ABOUT MOTLEY FOOL

The major reason behind the success of motley fool is the fact that it saves a lot of time for the investor. The dearth of time may not let an investor look deeply into the growth of the companies.

A hasty decision causes them loosing out on great stocks. Hence, the advice offered to them by certified financial advisors at Motley food helps them in having a varied portfolio.

The sustainable profit offered by motley fool comes with the association of a team of motley fool stock advisors who make the right kind of research and analysis in this regard.

The market analysis of this team is always top-notch and highly accurate. Hence, it helps in the success of its clients, leading to an enhanced level of satisfaction over the company’s research and other services.

Stockrover stock picks:

CLICK HERE TO READ MORE ABOUT STOCK ROVER

Apart from Motley Fool, Stockrover also offers great stock picks to investors. Initiated by two software engineers, it is an investment research platform, which saves a lot of time for the investors and lets them take quick decisions.

The benefit that it provides is that all the competing investors have access to the same kind of information at the same point in time. With the users giving timely suggestions, the curators are able to improve the working of this product from time to time.

Hence, its performance improves with every passing day.

This application surely simplifies the process of investments and reduces all the time wasted in making extensive spreadsheets regarding stock prices.

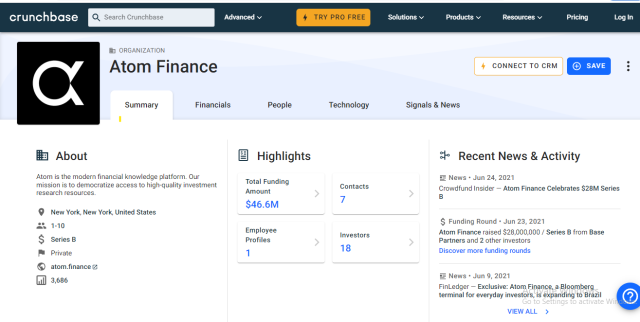

Atom Finance stock picks:

CLICK HERE TO READ MORE ABOUT ATOM FINANCE

Yet another tool to use in order to invest wisely is Atom Finance. Its stock picking services are also quite sought-after amongst the investors. It focuses on portfolio diversification, which enhances the chances of making a profit for the investors to greater levels.

It makes extensive research about high-growth stocks and informs the subscribers in a systematic manner.

By mingling science and technology with finance, it makes it quite easier for investors to understand this market. It also customizes the stock lists just according to the needs of the users.

Zacks Trade stock picks:

CLICK HERE TO READ MORE ABOUT ZACKS TRADE

Zacks Trade is also quite a helpful trade desk for independent investors. It offers stock pick services for those who don’t really have any idea about it.

It guides right from the basics and takes the investor to the intricate details with great ease.

The Zacks Investment Research manages assets worth more than 5 billion dollars, which makes it quite a successful venture.

Through its online forums, the company offers financial freedom to individuals. It does this by offering them extensive investment information.

The interface of the tool is also customizable, making it easier for the independent investor to get a hang of it.

Alongside this, it makes the account management process quite easy for the user by offering easy to understand data and details.

The Success Rate of David Gardner Stock Picks

Ever since its inception, the David Gardner stock picks have come up with great success. This level of accuracy is owing to the advanced and extensive form of research that the team of advisors makes to beat the market.

Over the last year, the company’s recommended stock pricks have made profits on a margin mentioned below:

- Shopify: 389%

- Zoom: 95%

- Netflix: 17622%

- Telsa: 2505%

- Intuitive Surgical: 3553%

Expanding the Portfolio with Motley Fool Stock Advisor

To stay on the safer side, it’s always recommended not to put all your eggs in one basket. This means that the more company stocks one buys, the more expanded his portfolio gets.

Eventually, one is able to maintain the financial status, and probably improve it furthermore without taking major risks.

Limited stock market knowledge can cause major problems for investors. Rather than making a random decision, getting aid from stock picks makes things a lot more convenient.

Stock picking advice and tips by Gardners:

David Gardner’s stock picks are not random choices. Rather, a team of certified financial advisors tend to offer the best advice on stock picking.

Queries of all sorts are also entertained, and guidance is provided on each step. The stock recommendations by David Gardner are the most authentic ones to go for.

The team of analysts starts off by realizing the trading purposes of the client.

Once it is made clear, it offers advice on high performing stocks while keeping a strong balance sheet of the client that it keeps updating.

Periodic earnings reports are also maintained by this team of analysts.

The provision of such extensive and accurate services makes the company the largest e-commerce platform for stock picks.

Investing in the long term:

Another amazing tip offered by stock advisor, David Gardner, is that one should invest in the long term. Rather than stock investing for 2 years, one should go for around ten years at least.

No matter what the starter stocks are, the duration should be at least ten years or more than that. The special sales page of the company offers this long period of investment for individual stocks.

This gives a better growth potential of the profit. David’s podcast has time and again repeated this tip. For a financial professional, it is surely a piece of great advice to go for.

Conquering Stock Market with David Gardner’s Stock Picks

This company, having an origin in Latin America, has been working in the corporate education markets for more than ten years.

Both David, as well as Tom, are known to be thorough professionals, who churn out the investment principles to their clients.

Motley fool runs on the principle of a diversified portfolio and well-informed stock selection. Clients are able to conquer the market by following the advice offered by David Gardner. He believes in investing in companies that have massive growth possibilities in the next ten years.

Hence, he believes in stock recommendations considering the growing organizations and their growth trends.

Long-term investment in stocks:

That one rule breaker service that David Gardner and Tom Gardner follow is investing in the long term. Mostly he gives the window of ten years while analyzing high-growth stocks and picking stocks. amazon web services platform has been his go-to investment priority.

He had started to recommend it when it first came on the internet, and he still does so! For the last twenty years, the world has seen the stocks of Amazin going up every single day.

Hence, the stocks that David’s followers placed on Amazon on his advice have aided the investors a lot.

The ideal Podcast for investment:

Building an investment portfolio that is sure to break all the industry rules and make profits is what he has been preaching through his podcast.

David’s podcast has spread a lot of awareness regarding investment principles and stock picking. His major tip is to ensure that there is a return of at least 20% on a stock per year.

Once that return is ensured, it doubles itself up within four years. In the next eight years, it gives a profit of quadruple.

Making the right stock picks according to the right stock market simulations leads to extensive profit margins.

Motley Fool Rule Breakers and Investment Opportunities

Motley fool rule breakers, a book authored by David Gardner and Tom Gardner offers the most appropriate David’s stock picks pieces of advice.

This is the third book by them, which explains the method one should go for when it comes to choosing stocks and buying them.

It gives additional information on the thought process that goes behind the idea of rule breaking investment. This book is basically a compilation of newsletters written by David and Tom, in which they offered tips and tricks to the readers on how can they become rule breakers when it comes to picking stock.

The reason why investors prefer and recommend David Gardner stock picks and rule breakers are its successful track record. By now, it has offered around 172 stock picks, and each of them has performed marvelously.

The fool’s rule breaker service is surely the best one in the industry, as its analysts are extremely well aware of the market realities.

Alongside this, it can aid investors in managing sticks for more than ten years. Only a few financial professionals offer these kinds of services to individual investors.

Stock selection following the advice of David Garnder, offered through his book or podcast, surely brings great benefits and expansion of profit in the future.

Fool’s breaker service by David Garden:

Once an investor subscribes to the fool’s ruler breaker service, he gets eligible for the stock recommendations. They get these recommendations every week, twice.

With all the investors having the access to the recommended company name simultaneously, each one gets an equal chance to choose the company.

Once the company is added to the portfolio, the chances of profit augment for all the subscribers.

Alongside this, a great advantage offered by it is the fact that the motley fool analysts check and analyze the time period at which the subscriber has added a stock pick in his portfolio.

Those who do it while wasting a minimum amount of time get eligible for a price reduction. Hence, being efficient in this regard aids the investors tremendously.

To make things feasible, the company sends an email to the subscribers announcing the exact date and time regarding the announcement of the next stock advisor picks will be released.

This makes the david gardner’s stock to be the most authentic one out there.

Advantages to get David Gardner’s stock picks

Getting David Gardner’s stock picks comes with a lot of advantages. These include:

a) Well researched stock picks

b) Equal opportunity to invest for all the subscribers

c) A guaranteed augment of profits by following the stock picks

d) Better awareness of the stock market trends

e) You are able to beat the market with better information

f) Ease of communication and quick help from the staff members

g) Possibility of a diversified portfolio

h) Offers long-term stock management

Investing in emerging markets

David’s stock picks tend to give great importance to the leaders in emerging markets.

According to stock recommendations by David Gardner, the highest revenue-generating companies of the market should be considered first while buying stocks.

This motley fool rule is owing to the fact that such companies that have high profit margins have lesser chances of falling back. Even if they do, they have enough capital that the fall doesn’t affect the stockholder.

With a larger market share, such companies have massive pricing powers, which allows them to make decisions that would help their investors.

While choosing stock picks, the motley fool says that emerging industries are what one should look forward to investing in.

Emerging industries are those that have replaced the previous ones and follow the new socio-economic patterns.

The emerging industries mostly relate to information technology, robotics, artificial intelligence, and others.

Rule breakers say that investing in these industries have a greater chance of profit in the future. It is also a secure mode of investment.

In order to be on the safer side to the most, the stock pick should be from varied companies and industries. This leads to portfolio diversification, which helps in reducing the chances of a major setback.

Disruptive innovation companies help in managing such multiple portfolios, in which investors can have stock of different companies at the same time period.

This way they are able to beat the market and have better and higher chances of success.

Same stock pick, over and over again, can be a cause of major economic description. Hence, a diverse portfolio is offered by David’s picks.

Conclusion

An advisor and rule breakers service by Motley Foam, a brainchild of David Gardner and Tom Gardner is one of the most innovative methods of choosing stock picks.

With a varied portfolio offered by it, David’s picks reduce the chances of financial instabilities and offer a greater level of security.

Motley fool stock advisor announced through rule breakers service – gives extensive growth potential to the investors.

Considering the actual trading purposes and major goals, the david’s stocks company’s financial professional team in Latin America is a dream team to get tips and services from.

So, how many portfolios do you think should be in one stock is enough to beat the market?

CLICK HERE TO GET MOTLEY FOOL AT A DISCOUNTED PRICE

The post David Gardner Stock Picks Analyzed [2021] appeared first on Dumb Little Man.

0 Commentaires