Sincerity is important. Integrity is important. It’s a movie phrase, but it’s especially relevant for firms in the financial sector.

Is the funded account provider OneUp Trader completely transparent about the criteria and specifics of their service to make a profit target?

How do they compare to the amount of transparency offered by other trading services?

Let take look to know whether a OneUp Trader Funded Account is suitable for you to make a profit target.

OneUp Trader Review: Here Is How All This Work

What Exactly Is OneUp Trader Funded Account?

OneUp Trader is indeed a funded accounts provider that offers a risk-free money access funded trading account platform.

With a decade’s worth of funded accounts, the OneUp team does not advocate for an ‘in-house’ best characterized.

Rather, the firm concentrates on developing successful traders from within, encouraging independent decision-making.

OneUp aims to enable funded account traders, like-minded traders, by promoting its fundamental values.

The team’s goal is to create a seamless transition from the point of getting began to a point of getting financed in profit target from their account balance.

Their courses are also free of hidden fees and do not need any further payments after you join up compared to other trading program.

CLICK HERE TO READ MORE ABOUT ONEUP TRADER

OneUp Trader Subscription

Funded Trading Account Of OneUp Trader

A OneUp Trader Funded Account, which is formed methodically and covers all the intricacies in the process, allows you to trade risk-free using the funds of the OneUp team.

Before you can begin, you must first complete the following five steps:

1. Specify the size of your funded account balance and the profit target split.

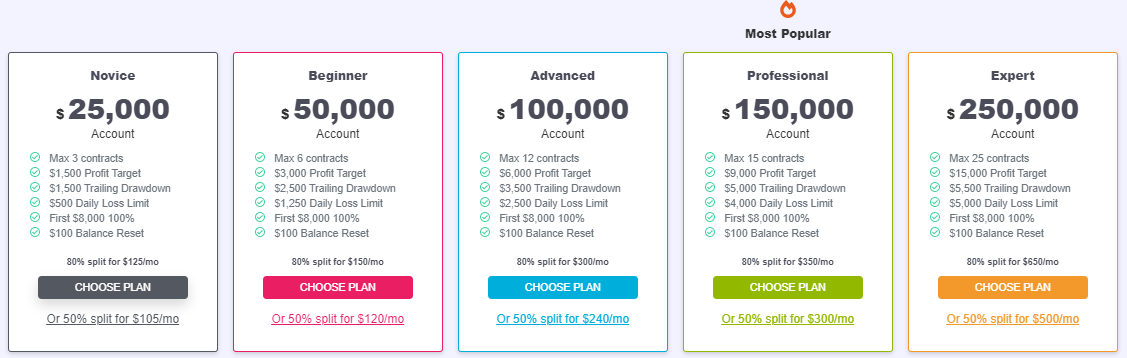

Account amounts at OneUp Trader range from $25,000 to $250,000.

You may pick between a 50 percent profit target split and an 80 profit split of daily profit target, depending on the option you select on profit target.

80 profit split in profit target can cover the daily loss limit if you have to.

80 profit split is quite a high number compared to the daily loss limit in a lower number of daily loss limit.

You pay $95 each month to obtain a $25,000 financed account with a 50 percent profit share.

Aside from the profit objective, you will also be informed of your trailing drawdown and loss limit for the day.

2. Demonstrate your ability to administer your account.

Step 2 is about displaying the trading abilities.

At the onset, OneUp’s staff lays you a comprehensive list of qualifications to guarantee you do whatever it requires to thrive as a trader.

Please note that OneUp Trader’s level of openness is indeed what makes it so amazing.

3. Select your favorite trading market platform.

OneUp Trader, in keeping with its pledge of independence, does not compel you to utilize its program or any extra add-ons.

Although the Ninja Trader platform is its preferred trading market simulated account options because of Ninja Trader interface that you can use for free trial on evaluation period.

There are over 19 additional alternatives available.

4. Share, discuss, and evaluation stage of your plan.

You will only be allowed to trade a restricted number of currency futures, commodity futures, and E-mini futures during the assessment as evaluation rules.

Same account size as utilized for assessment in the account sizes, trading account sizes in OneUPTrader also offers guaranteed placement with its funding partners on the evaluation stage.

The dashboard is jam-packed with fantastic features:

- You may interact with other OneUp Trader funding partners or other traders in the community by posting, sharing, and following them in funded trading.

- Get access to a wide range of vast funding network and trading account analytics.

- Take part in a live community chat.

Get access to the most recent market news, not past performance:

- Get the most recent economic data and account analytics.

- Data on the most recent market shakers and movers and detailed trade analysis.

- Streaming of financial industry news networks in live community chat

OneUp Trader Offers No Risk In An Actual Trading

There isn’t any risk in OneUp. Trading involves significant/substantial risk and is not suitable for all investors.

Money that can be lost without jeopardizing ones financial security stability or way of life is referred to as risk capital.

Trading should be done with only risk capital, and only those with sufficient risk capital would undertake trading.

Because you are trading using OneUp’s funds, all losses are borne by the company.

Of course, the monthly data fees compensate for this, but there is no danger on the downside of your account.

Your account size determines your profit objective during the 15-day trading day assessment period, as well as the daily loss limit & trailing drawdown.

Daily loss limit and trailing drawdown are evaluation fees for an account, also monthly fee.

Therefore, it is critical to remember that OneUp Trader has minimum limits of the amount you may remove from the trading.

Free Trial Of OneUp’s Business Model

More significantly, giving trial access demonstrates that OneUp stands behind its service.

Funded traders must trade consistently in your trial time with your account.

Who Should Use OneUp Trader?

OneUp Trader is advantageous to funded traders of all levels of skill.

OneUp Trader staff provides instruction, investing resources, and, most importantly, access to cash, offering a perfect balance between price and value account.

Whether you’re new to trading, you may take advantage of its professional teaching while still having no downside risk in your account.

Furthermore, the account as compared to the cost of purchasing portfolio protection, trading using OneUp Trader money is highly advantageous.

CLICK HERE TO READ MORE ABOUT ONEUP TRADER

Alternative Social Trading Platform

1. Motley Fool

Since 1993, the Motley Fool has provided stock recommendations and investing advice.

It is still among the world’s leading financial media firms more than two decades later.

Advantages

-A twenty-year track record

-Consistently outperforms the market for a account

-Stock selections are simple to implement.

-Members have immediate access to 20 starting stocks.

-Every month, there are two new stock selections.

-Guaranteed money back

Disadvantages

-Upsells are vexing.

-Several stock choices are duplicates.

CLICK HERE TO READ MORE ABOUT MOTLEY FOOL

2. Trade Ideas

Trade Ideas is a growingly popular sophisticated scanning tool.

The platform includes sophisticated scanning technologies as well as machine intelligence.

Advantages

-The platform is simplified with TI University material, instruction, and live webinars on a account.

-Powerful scanners with a plethora of built-in scans.

-AI-powered Holly offers simple transactions with up-to-date portfolio tracking.

-Oddsmaker’s customizable strategy scans can be optimized.

-Experts and moderators with extensive expertise assist.

-Methods can be exchanged with the public and administrators through the server.

Disadvantages

-For newcomers, the training can be steep.

-A premium subscription is pricey.

CLICK HERE TO READ MORE ABOUT TRADE IDEAS

3.TrendSpider

TrendSpider is a one-of-a-kind new product in the area of technical analysis, with a plethora of automated features an account, and AI-assisted technical expertise that really will wow even the most seasoned traders.

Advantages

-Plethora of automated technical analysis

-Customizable alert settings

-One-on-one user training exercises are provided at no cost.

Disadvantages

-A learning experience for first-time customers

-It should only be used in one browser at a time.

-There’s no workstation platform choice.

CLICK HERE TO READ MORE ABOUT TRENDSPIDER

5. IQ Option

Unlike some other operators who utilize a conventional trading platform, IQ Option uses a customized custom-built platform to meet the demands of its customers.

The system is simple to use and well-designed.

It’s also accessible in a total of 13 other languages.

Wide range of assets and financial products on the IQOption trading platform, including stocks, digital options, which means that different, forex trading, cryptocurrencies, ETFs, and goods and services.

Advantages

-The Cyprus Securities and Exchange Commission oversees market regulation (CySEC)

-Account opening is a simple and straightforward process account.

Disadvantages

-Does not offer MT4 and MT5 trading platforms to traders in the United States, Canada, Australia, Japan, and other countries.

CLICK HERE TO READ MORE ABOUT IQ OPTION

6. Ledger Nano

The Ledger Nano S electronic cryptocurrency wallet has a secure chip and a unique operating system that enables high-level security.

Offers investors authority over their private keys and is backed by the industry’s biggest name.

Investors may store over 1,100 coins and tokens on the Ledger Nano S, with Ledger, natively supporting 23 cryptocurrencies and the remainder provided through installed third-party applications.

Advantages

-A low-cost cold wallet

-The private keys are never removed from the device.

-They are never deleted from the device or made available over the internet.

-It accepts around 1100 currencies and tokens.

Disadvantages

-Crypto applications have a restricted amount of storage space.

-The display is tiny and does not have a touchscreen.

-Other wallets are more mobile-friendly

CLICK HERE TO READ MORE ABOUT LEDGER NANO

Conclusion

In the vast majority of regular trading pattern such as Motley, Trades Ideas,... as mentioned above.

Every trading system has its own benefits as well as its drawbacks, you should be an experienced trader with a funding partner, even it’s not easy to succeed from an initial investment, maybe you even get potentially lose.

Nevertheless, not only trading talent can be successful traders, a trading career with a specific trading strategy and advanced trading statistics would help you in making largest day’s net profit someday also.

But it’s not mean that it’s necessarily indicative in a winning strategy in the future.

One of the best options

In my way of thinking, become OneUp traders should be considered by newcomers because of its good points.

OneUp Trader gives a fair and honest introduction to the world of funded accounts.

The website lays out its five procedures for grant eligibility in detail.

Whatever you choose, the OneUp Funded Account is one of the best alternatives.

CLICK HERE TO GET MOTLEY FOOL AT A DISCOUNTED PRICE

CLICK HERE TO GET TRADE IDEAS AT A DISCOUNTED PRICE

CLICK HERE TO GET ONEUP TRADER AT A DISCOUNTED PRICE

The post OneUp Trader Review 2021: Is It Really Worth? appeared first on Dumb Little Man.

0 Commentaires