Relative volume is a measure of the magnitude and direction of trading activity for given security. It is also used to compare the current volume to past volumes, or an index’s average volume, to identify periods of increased or decreased market activity.

Relative volume can be calculated as either:

(1) total volume for the period divided by share price times shares outstanding; or

(2) total shares traded during the period divided by share price times shares outstanding.

This blog post will give you some key facts about relative volume and how they are applied in trading.

What is Relative Volume?

Relative Volume is a mathematical concept that measures the relationship between the volume of stock traded in one security and another.

The relative Volume ratio can be used to compare volumes on different days, securities mentioned, or exchanges. The relative volume number for each security is found by dividing today’s trading volume by yesterday’s trading volume.

Relative Volumes are expressed as a percentage value and range from 0% (indicating no change in price) to 100%. A high relative volume ratio with an upward trend indicates demand for the security is increasing while a low relative volume with a downward trend indicates weak demand for the securities brokerage.

How do you calculate relative volume?

To calculate Relative Volume:

1. Find the daily volume for the current period and the daily volume for a selected period. To find daily trading volume, divide Trading Volume by the number of trading days in that trading session (one day for most equity and options markets).

2. Divide today’s Trading Volume (current period) by yesterday’s Trading Volume (previous period). For example, if today’s Trading Volume is $100 million and Yesterday’s Trading Volume is $200 million then today’s Relative Volumes = $100m / $200m = 50%.

3. When you know both of these numbers, find how they relate to each other:

53% > 100% – This means that trader activity was higher today than it was yesterday.

51% = 100% – This means that trader activity on both days is the same (no directional bias).

48% < 50% – This means that trader activity yesterday was higher than today.

49% < 51% – This means that trader activity today was higher than yesterday.

50% = 51%: No directional bias; volume equal on both days.

When using Relative Volume to trade, look for confirmation of a price trend with Volume-Price Analysis before entering a position, and enter an order at the close of the day when confirming your trading signals.

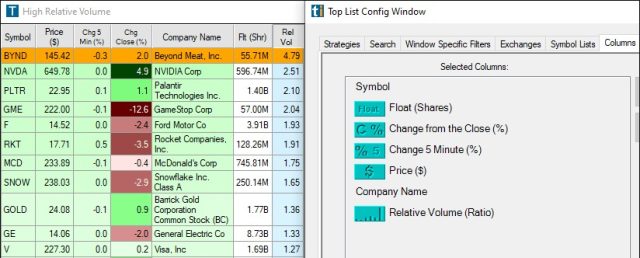

Relative Volume Indicators

The Relative Volume indicator shows you whether the trading activity is increasing or decreasing, and it lets you compare the volume of two periods—for example, today’s volume compared with the average daily volume for that security during the last 40 days.

There are three types of Relative Volumes: Percentage Volume, Money Flow Volume, and True Strength Volume.

They appear as shaded bars on a chart, either above or below prices depending upon their type.

Most traders get to know high relative volume, average volume, low volume, day’s volume on a specific stock using this.

Percentage Relative Volume Indicator:

This type of Relative Volume is an indicator of demand or supply pressure in stock by measuring how much trading volume happens at different price levels relative to its previous day’s close.

For example, if yesterday’s close was $50 and today’s high is $51, then the volume at the 51 price level would be 50% of yesterday’s total volume.

Percentage relative Volume indicator is a lagging indicator that signals when a trend has been established.

It may not give you immediate entry or exit signals on your charts because it takes time to confirm an uptrend on up days, downtrend on down days, and sideways trends on unchanged days.

A day trader will have info on stock average volume, stock high relative volume, day average low volume using this.

Money Flow Volume:

This type of Relative Volume measures demands or supply pressure by measuring how much buying or selling activity has occurred during different price levels relative to its previous day’s median price.

Money Flow relative Volume gives you an idea of market participation at various prices—how many buyers and sellers have into a stock based upon the amount of activity during different price levels.

Day traders may know about stock average volume, stock high relative volume, day average high volume using this to make an investment decision.

True Strength Volume:

This Relative Volume indicator measures institutional buying or selling pressure by measuring how much buying or selling activity has occurred at different prices relative to its 52-week high or low.

For example, if the current year’s relative volume range gets compressed into half of what it normally trades for an entire year, then there may be more upside to come over the next few months than there is downside risk.

Why is it important to know the relative volume?

The high Relative Volume is one of the most useful tools you can use to confirm support and resistance levels.

The uptick in relative volume confirms that many traders are interested in a particular market move while the downtick in relative volume shows a lack of interest and reduces volatility.

It will show you when there’s enough power for a trend to continue and eventually become self-sustaining, and at what point there isn’t enough power to propel price action any further – this is important because it gives you insight into where the next major turning points might be.

How can you use this information to make better decisions?

You can use high Relative Volume to help you choose which stocks to trade, or when to enter and exit, by simply looking for patterns in the volume indicators that correspond with price trends.

This method of technical analysis is also called Point-and-Figure (P&F) Analysis. P&F charts are easy to follow because each column represents one period without regard to time.

The columns represent market movement based upon the relationship between the high and low prices over specific periods of time.

With this type of chart analysis, there are only two types of columns: X’s and O’s.

When an X appears within a column, it means that today’s closing price was higher than yesterday’s closing price therefore, the previous day’s high is now today’s low, and vice versa.

When an O appears within a column, it means that yesterday’s closing price was either the same as today’s or lower than today’s therefore no change has taken place at this level, and vice versa.

The volume indicators are displayed beneath the stock chart because you can look back in time to compare relative volume across different years.

X-Columns represent up days with higher lows and O-Columns represent down days with lower highs which makes it easier to identify trends for entry and exit signals.

Once you know what you looking for on your P&F charts, it is easy to identify volume patterns that correspond with price trends.

For example, the series of X-Columns on the left are bullish volume indicators because each successive bar has a higher low—a strong indication that institutional buying pressure is building up which could signal an uptrend.

On the other hand, O-Columns represent bearish volume indicators because each successive bar has a lower high—a strong indication that institutional selling pressure is overwhelming the market which could signal a downtrend.

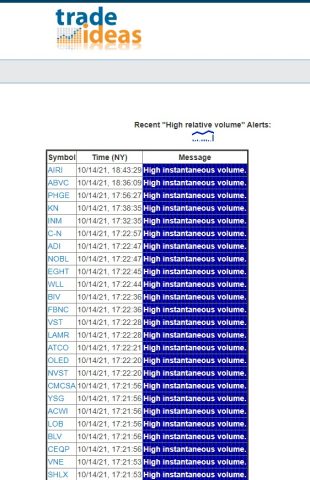

AI Platforms for Relative Volume

1. Trade Ideas

Trade Ideas is an app that uses artificial intelligence to scan the entire universe of stocks to find investment opportunities.

It scours through over 160 million global data points daily to generate an average of 1,000 new trading ideas for you each day.

You get alerts when there are breakouts or breakdowns in any of these securities which makes it easy to make faster buy/sell decisions.

You will get info on high relative volume ratio, intraday volume distribution curve, stock’s average volume, trading stocks day average, unusual volume, direct or consequential loss on a number of shares, particular investment past performance, day trading liquid stocks, investment research, high volume plus low volume trading opportunities, qualified securities consequential loss arising, the potential value of given stock and much more on this day trading platform using high relative volume scanner.

CLICK HERE TO READ MORE ABOUT TRADE IDEAS

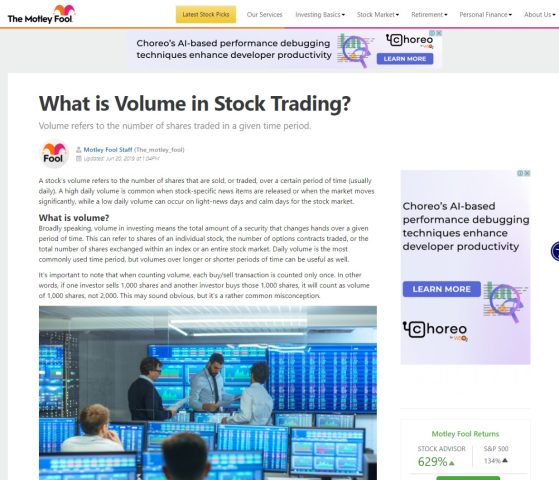

2. Motley Fool for Average Volume

The mission of the Motley Fool is to help the world invest better.

You will get to know the trading strategy based on a high relative volume using necessarily indicative volume bars. There’s an option to get a trading education to help you find stocks high-volume trading strategy that gives more liquidity on basics box trading for informational purposes.

It also offers two newsletters—One Million by One Million, and Rule Breakers—which provide trading strategies to help you increase your wealth using a high relative volume scanner.

The table of contents can be referred to read on the stock.

CLICK HERE TO READ MORE ABOUT MOTLEY FOOL

3. Binance for Relative Volume Ratio

Binance is a cryptocurrency exchange with support for multiple languages and mobile apps which makes it easy for Apple and Android users.

In the education tab, there is the table of contents on stock for informational purposes that you can refer to and use the knowledge at your own risk.

New traders, day traders, and more traders can get legal advice on liability whatsoever, investment advisability on average volume, high relative volume, trading strategy to add relative volume for a specified number of shares, more volume on day trading from investment adviser and qualified securities professional.

CLICK HERE TO READ MORE ABOUT BINANCE

4. Finviz

Finviz is an app that uses color charts to help you identify the best money trading stocks for purchase or sale at any time.

The chart can be filtered by sector, industry group, market cap, price change today, one-year gain/loss, year-to-date gain/loss, and net percent change.

Each stock also comes with a 3-month performance history which makes it easy to know if the financials behind it are trending up or down.

This historical data includes assets under management (AUM), earnings per share (EPS), book value per share (BVPS), revenue growth rate, net income growth rate, dividends paid, return on equity (ROE) percentage, return on assets (ROA) percentage, operating margin, gross margin, and price/earnings (P/E) ratio.

CLICK HERE TO READ MORE ABOUT FINVIZ

In Conclusion

One of the most important indicators for a day trader and other traders is Relative Volume. This indicator tells you how much volume was traded in a certain time frame, and it’s one way to tell if an asset has momentum or not.

There are many ways that people use this information to make better decisions on the stock market, but AI trading platforms like Trade Ideas offer some interesting features for both newbies and pros alike. For example, they can give you specific trade ideas based on your risk profile so you don’t have to spend hours researching before making any trades. They also provide data-driven insights into markets with their real-time newsfeeds and charts which may help more novice traders stay abreast of the latest trends.

CLICK HERE TO GET TRADE IDEAS AT A DISCOUNTED PRICE!

F.A.Q.

What Is Relative Volume?

Relative volume is the indicator that calculates the volume for a particular stock relative to the total market volume.

It is calculated by dividing the current day’s trading volume of security by the average trading volume, which is found by taking the average trading volume of the security’s trading volumes during each of the previous days.

This tells us how active this instrument has been over certain periods so we can determine if prices are moving up or down.

How To Find Relative Volume Of A Stock?

You can find this information on the “Volume” box to the right of any stock chart. If you click anywhere in that box, it will populate all of your charts with Relative Volume.

CLICK HERE TO GET TRADE IDEAS AT A DISCOUNTED PRICE!

The post All-Inclusive How-To Guideline For Relative Volume 2021 appeared first on Dumb Little Man.

0 Commentaires