Charles Schwab is the top discount broker in the United States. The company is widely known for its excellent customer experience, customizable trading platforms, and 24/7 customer service among others. The company provides both in-person and online trading platform.

The company on the listing of New York Stock exchange and regulated by top financial authorities like Exchange Commission, United State Securities, and FIRA. Charles Schwab Corporation provides more education for advanced and new investors, detailed research, and amazing packages for investors regardless of their skills. This Charles Schwab review 2021 covers everything you need to know about this online broker.

Charles Schwab Review: Pros and Cons

Charles Schwab countries of regulation include the USA, Singapore, UK, and Hong Kong. Their trading charges class is low and they do not charge an inactivity fee. Another highlight is that their withdrawal fee amount and the account minimum deposit are zero. It takes one day to open an account, and you are provided with a demo account. The products they offer include mutual fund, stock and ETF, futures trading, bond, and options. It also offers market commentary from Morningstar, Credit Suisse, and Ned Davis among others.

Charles Schwab provides stock and ETF trades. This online broker offers services like financial advisors, investment advice, educational resources, and Schwab intelligent portfolios. Not to mention the securities investor protection corporation for their clients. Customers also enjoy commission free trading and review their investing strategy through personal consultation. Here is a breakdown of Charles Schwab’s pros and cons.

Pros

· Detailed market research and insights.

· Offers stock and ETF trades.

· Top-notch trading platform.

· A quality trading platform featuring customizable tools.

· In-person support, phone, and live chat customer service.

· Great security and reliability.

Cons

· Some mutual fund fees are high.

· Markets are only available in the US and Canada.

· They don’t have a paper trading platform.

· They don’t provide cryptocurrency assets for trading.

· Charles Schwab’s margin rates are not the best.

Trading Fees

The Company provides stock & ETF trades. Some of their bond and mutual fund are free and the non-trading feed are lower. However, they have higher fees for a non-free mutual fund. Their fees can be ranked as either high, average, and low when compared to other online brokers. Before we get into details, let’s understand the difference between trading charges and non-treading fees.

Trading costs refer to the fees that take place after trading. They can be in form of commissions, conversion fees, spreads, and financial rates. On the other hand, non-treading fees are charges that are not concered about trading. They include inactivity fees and withdrawal fees. Visit the Charles Schwab website to find more about their trading and non-trading fees.

Trading Fees Breakdown

Charles Schwab provides low trading fees for active traders with an easier fee structure system.

Stock fees & ETF trading fees: They do not charge any commission for ETF trades and stock trading. If you would like to trade stock on margin, it is worth checking the company’s margin rates. This means you can ask for money from a broker and buy extra shares than the money you have. This calls for an interest for the amount of money you borrow (margin rate). They have a high margin rate because you have a baseline and the premium based on the money you borrowed.

Fund Fees: They have high fund fees apart from mutual funds of 4000 for free trade. They have a standard charge of $49.95 for every purchase and free redemption. Compared to other brokers who charge when you buy or sell, Charles Schwab is great because they provide mutual funds of 4000. You can use it for free trading. However, you have to sell them in a 90-days period, or else you will incur a redemption fee of $49.5.

Bond Fees: Their bond fees are low based on thebond type. They don’t charge commission for treasury bills and treasury notes, etc. Treasury bonds with no coupon and corporate bonds have a commission of one dollar for every bond. This is with a $10 on the lowest and on the highest $250. However, the price of the bond might also include markup that shows the bid-ask spread without capping.

Option Fees: They have lower options fees are low of up to $0.65 for every contract.

Future Fees: They have average future fees.

Non Trading Fees

Their non trading fees are lower without account fees, annual or inactivity fee to pay. Even if you have IRA accounts, there is no requirement for account minimums. For ACH transfer, you don’t incur any transaction fee. Withdrawing to various banks through wise transfer charges a transaction fee of $25.

CLICK HERE TO READ MORE ABOUT CHARLES SCHWAB

Charles Schwab Account Details

Charles Schwab discount broker targets are clients from the US. They also provide services in other 40+ countries worldwide where customers can open Schwab global account. Opening Schwab accounts is easy and fast in this digital era. US Schwab customers do not have account minimum deposit but other clients are required to transfer $25,000 as account minimum to begin.

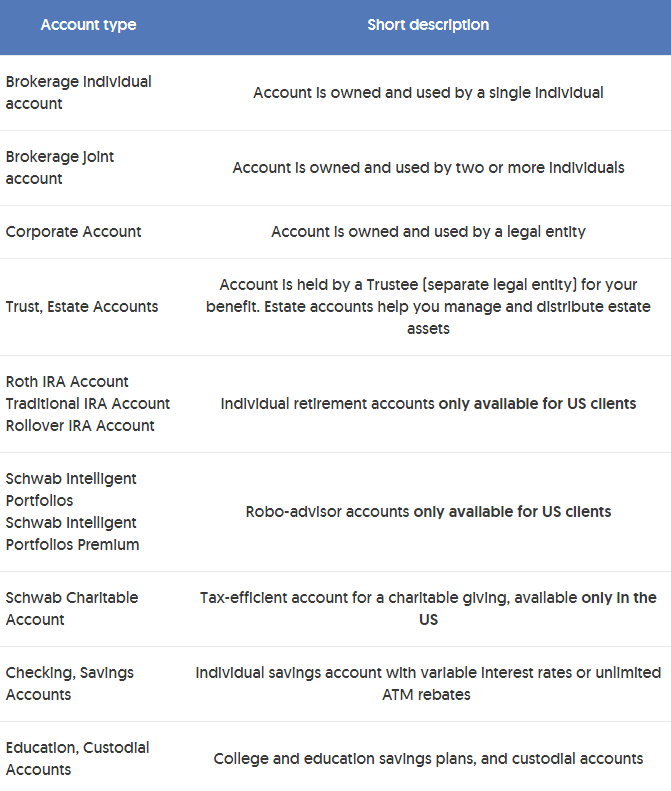

Types of Accounts

Charles Schwab provides different types of accounts which include:

In Schwab brokerage accounts, trading, and individual account, they have some services which do not match to a particular account type. They can be for insurance services, lending, or annuities.

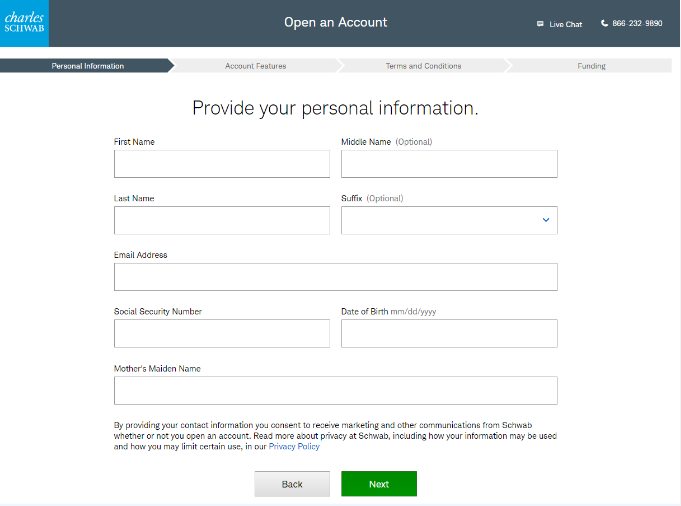

Account Opening

Opening accounts follows a fully digital process and it can takes less than one day to finish. Online applications take roughly 20 minutes, and by the next day, your account is approved. Follow these steps to complete the account creation.

· Choose the type of account you want to open.

· Fill in the required personal details like residency, employment status, SS number, and much more.

· Set the necessary account details like options trading or adding margin.

· Agree with the terms & conditions.

· Upload your ID or driver’s license to verify your identity.

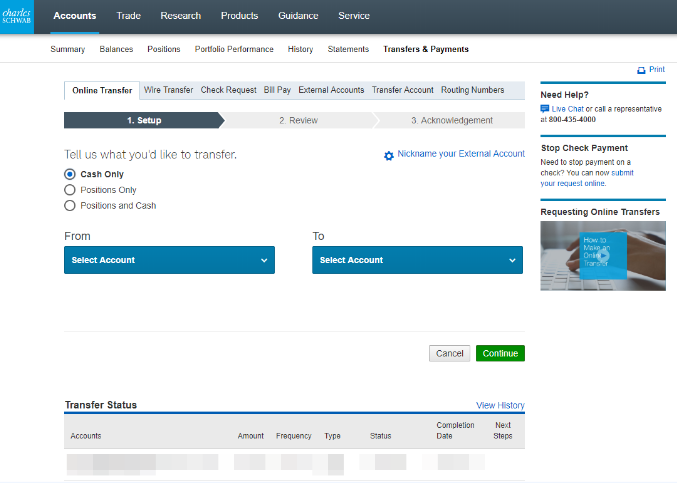

Deposits & Withdrawals

Charles Schwab offers a convenient way to add money to your account since they don’t charge deposit fees. But if you want to withdraw your money through bank transfer, you will incur withdrawal fees. There are several deposit options for US clients since they can use wire transfer, check, and electronic. Non-US clients can only use wire transfer.

However, you cannot use debit cards, credit cards, and electronic wallets when depositing. Deposits can only be done on accounts bearing your real name. Charles Schwab only provides USD currency. If your current account is in any other currency, you will incur conversion charges. You can save more on currency conversion by opening a multi-currency account with any digital bank. Not only will you enjoy better exchange rates but also low international bank transfers.

Charles Schwab doesn’t charge a transaction fee when using ACK methods. However, wire transfer has a transaction fee of $25. It takes about two business days for withdrawals using ACH. Again, you can only pullout money to accounts bearing your real name. Follow these simple steps for easy withdrawal.

· Sign in to your Charles Schwab.

· Click “Transfers and payments.”

· Choose the method you prefer to withdraw.

· Click “Transfer from.”

· Choose the bank accounts you want to send as “Transfer to.”

· Insert the withdrawal amount.

· Complete the withdrawal.

CLICK HERE TO READ MORE ABOUT CHARLES SCHWAB

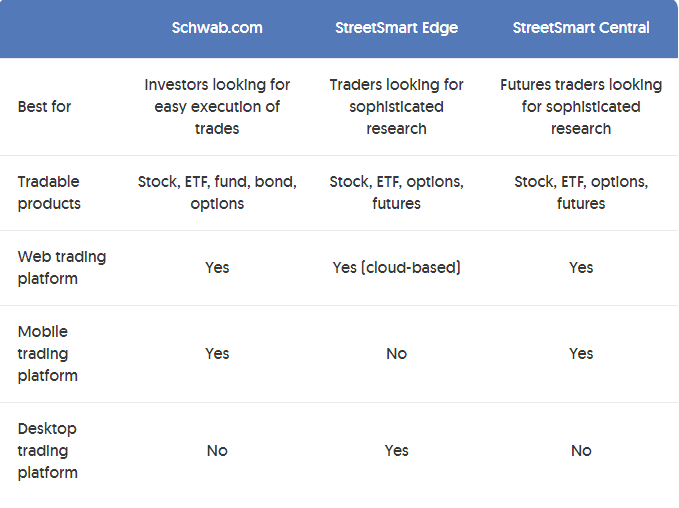

Trading Platforms

Charles Schwab provides web, mobile, and desktop trading platform. The products they offer vary based on the platform and the available device. Let’s have a quick look at each of these trading platforms.

Web Platform

Charles Schwab offers one of the best web trading platforms. It is user-friendly, provides price alerts and clear fee reports. On the negative, the web-based platform provides limited customization for charts and workspace. In this Schwab review, the platform on the web is in English.

Login & Security

Active traders can log in Charles Schwab website in one step. However, there is also a 2-step confirmation process. You can enable the two-step authentication on your desktop app, mobile app, or physical token. The physical token is available on their Admin page.

Both desktop and mobile trading platforms utilize Symantec VIP. You can have it to your device easily after downloading. Go to the “Schwab Advisor Center’,” and click your name choose “Authentication device. Next, open the Symantec VIP and enter your identity and the passowrd. When logging in to your brokerage account for the first time, register your phone or laptop, and you will get a code through text. After completing the registration, access your Charles Schwab brokerage account using those details.

Search Functions and Placing Orders

There is a search function to help you look for the name of the company. But you will not always get relevant results to your search. There are different types of order types which include:

Market order- This is the basic type of order you can choose. In this case, your trade is executed at the prevailing best price. This is ideal if you prefer your order to be fulfilled right away.

Limit order- This order type allows you to specify the limit price which you want to purchase or sell a particular asset. Your asset is only bought or sold after reaching or passing the pre-set limit.

Stop order- After executing your market to limit buy order, there is a vacancy if you would like to reduce your losses and secure profits.

Stop limit order- This order works in case the price of the asset you hold goes up. This means you stop the order by closing your position. If it moves back near the initial price, a stop-limit order comes in handy.

Alerts & Notices

It is effortless to get many research and price alerts among others. They send the notification to your email or through SMS. Set the mobile push notification if you download the mobile app. Find the alerts in the Alerts section. Additionally, Charles Schwab provides fee reports and a clear portfolio.

Mobile Platform

The Charles Schwab mobile app trading platform is user-friendly. The Schwab mobile provides biometric login with a tough or face ID. The mobile app has a similar design and function like the web trading platform. The downside of the mobile app is it doesn’t have price alerts. In this Charles Schwab review, we tested this mobile platform and it works well for Android and iOS devices. Schwab mobile provides the same search functions, order types, and login process just like the web platform.

CLICK HERE TO READ MORE ABOUT CHARLES SCHWAB

Desktop Trading Platform

Unlike other online brokers, Charles Schwab’s platform is easily customizable. It provides a wide range of orders and clear fee reports. This platform only works for Windows. It is also slow to load especially if you are clicking different tabs. Charles Schwab provides a streetsmart edge as the only option desktop platform. Before you download the streetsmart edge, you can also use the free demo provides, which works well.

Search Functions

The search functions work well and you can search asset names or search tickers. Like the web-based platform, the searches are not always relevant. Placing orders is also similar to the web platform.

Alerts & Notifications

On this platform, alerts are set on the streetsmart edge. However, you get fewer alert options than the web trading platform. This platform also provides order confirmations and price alerts. For portfolio holdings and fee reports, streetsmart edge provides them in the Account Detail section.

Markets and Products

There is a wide range of asset classes you can trade at Charles Schwab ranging from stock trading to futures trading. However, the product portfolio is only available for Canadian and US customers. You can select various bonds and funds at Charles Schwab. The availability of futures and options is average. The products they offer can differ from one country to the other. For instance, traders in Hong Kong and the UK only trade with bonds, stocks, options, and EFTs. They don’t have trading futures and mutual funds.

Stocks and ETFs

Charles Schwab covers the North American Markets. It is easy for traders to trade with stock on various stock exchanges like OTC, NYSE, NASDAQ, and NYSE MKT. you can trade Canadian stocks online via a broker with a phone. Most Canadian securities online quotes are offered by Toronto Stock. Exchange and displayed in USD.

Schwab offers fractional shares to their customers. Their fractional shares are of S&P 500 stock so you don’t have to buy the full share of a particular stock. With the fractional shares option, you can buy Schwab stock slices to stand for a partial share with as low as $5 penny stocks. You can trade foreign exchanges in the UK, Australia, Japan, European Markets, and Hong Kong with a separate Schwab Global Account.

Funds

Schwab offers various mutual funds. The mutual funds are available from bigger providers like Vanguard, BlackRock, TD Ameritrade, and other smaller providers.

Bonds

You enjoy a wide range of bonds at Charles Schwab. Customers have access to both corporate and government bonds.

Options

Schwab offers various trading options using exchanges like EMLS, BATS, MPRL, BOX, C2, and EDGX among others.

Futures

You also enjoy an average selection of futures with exchanges like EUREX, CBOT, COMEX, CME, and ICE among others. Additionally, Bitcoin futures are available for trade.

Schwab Intelligent Portfolios

Schwab offers the Schwab Intelligent Portfolios which is ideal if you want an automated investment strategy. Before using the robo advisor, you need to answer various questions regarding your investment goals, time horizon, and your risk tolerance. Depending on your preferences, the robo advisor creates a portfolio and balances it automatically. Fund investors need a minimum of $5,000 to start, and they don’t charge account fees or commission for the service. For Schwab Intelligent Portfolios Premium, fund investors get a personal investment advisor. This account needs a minimum of $25,000 and a one-time fee of $300. After that, you pay $30 account fees monthly.

CLICK HERE TO READ MORE ABOUT CHARLES SCHWAB

Research

Charles Schwab stock market research is excellent. They have great research tools, useful data, and trading ideas for ETFs and stock. However, it can be tough to use the research tools. Charles Schwab’s research tools work well on the desktop platform than other platforms. You get free stock quotes without any subscription. Their research tools are available in English only. The most common stock tools include mutual funds, screeners for stocks, and ETFs. These tools allow you to use various filters from basic to technical ones.

Trading Ideas

Charles Schwab also provides customers with trading ideas for ETFs and stock, which you can find in the “Ratings” and “Reports” sections. The information is crucial to help you know if you should buy, hold or sell stock.

Fundamental Data

There are several fundamental data you get on stocks, funds, and assets. You can easily get reports of your financial statements for a given particular time, dividend calendar, and peer group companies among others.

Charting

They have excellent charting tools which are easy to edit. Charles Schwab provides up to 56 technical indicators which are higher than other online brokers.

News Feed

Their news feed is good but it doesn’t have visual elements like pictures and charts. Such visuals are offered by third parties like Reuters.

Customer Service

Charles Schwab is known for its excellent customer service. They provide 24/7 services and give quick and relevant answers to your questions. You also enjoy live chat and phone support. However, they don’t provide email support.

Education

They plenty of articles and high-quality videos that you can use for learning. You can learn various things like:

· Webinars

· Platform tutorial videos

· Educational articles

· General educational videos

They have many webinars like 5 per day which cover various topics ranging from trading to stock and much more. You can learn how to trade futures and socially responsible investing. The negative side of their education resources is that they are not structured properly. This means it can be hard to find particular information.

Safety

Charles Schwab’s security is top-notch. They are regulated by authorities like SEC hence clients get the best investor protection. Compared to other European brokers, there is no negative balance protection when trading on margin.

Who regulates Charles Schwab and Is It Safe?

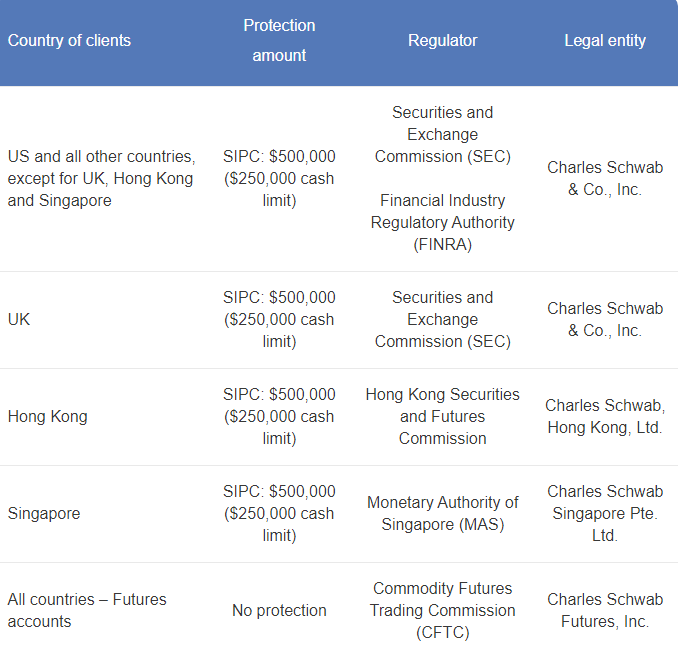

Charles Schwab is regulated by SEC, FINRA, CFTC, SFC, and MAS, all in the US. Charles Schwab is safe to use because all its customers are covered under the US investor protection scheme (SIPC). This protects you against cash loss, securities, and the against the broker. SIPC covers mutual funds, stocks, notes, bonds, and registered security. It doesn’t cover unregistered limited partnerships, unregistered investment contracts, currency, commodity futures, fixed annuity contracts, and interests in silver and gold. Below is a summary of the various regulators, protection amounts, and legal entities.

Charles Schwab Background History

Charles Schwab was founded in 1971 by Charles Robert Schwab and it has over 400 branches in the US. In 1975, the founder created a brokerage when trading and commission were regulated on Wall Street. He didn’t provide investment advice or stock recommendations. He majorly concentrated on executing trades, and the company became bigger.

The company was acquired by the Bank of America in 1983. After four years, Charles Robert Schwab bought the company back. The company went public in 1987, just a month before the market crashed. In 1997, Charles Schwab was then added to S&P 500 index funds. Charles Schwab has a trading license and it is listed on the NYSE. This is a safety advantage because their financial statements are transparent and regular. Charles Schwab is also regulated by top regulators which makes it safe.

CLICK HERE TO READ MORE ABOUT CHARLES SCHWAB

Conclusion

Charles Schwab is a popular full-service brokerage trading. They also provide detailed research, investor tools, retirement accounts, and fundamental data. They have excellent customer service who attend to your queries quickly. Additionally, they don’t have account minimum fees and no-load

mutual funds.

The Schwab review above has given you everything you need to know about this US broker. Compared to other brokers, they have low trading and non-trading charges. Opening an account is also an easy process. You can as well choose Interactive Brokers, which is another leading online trading platform for advisors, investors, and traders.

From the Charles Schwab review, you can as well note some downsides. Apart from the 4,000 mutual funds that offer free trade, the mutual funds costs are high. Again, the product portfolio is only for US and Canadian customers. Lastly, their educational platform is not the best.

F.A.Q.

Q: Are there hidden fees with Charles Schwab?

A: Charles Schwab doesn’t charge on account opening or maintenance fees. You also don’t incur any commission fees on Schwab’s mutual funds, stock, and ETFs. However, they charge trading fees for non-Schwab mutual funds and options. There are other additional fees like brokerage commission, fund expense, and some account fees. For a better understanding, check Charles Schwab’s price page online.

Q: Can you recommend Charles Schwab for beginners?

A: Absolutely. It has various low-cost index funds, intelligent portfolios with zero fees, and ETFs. This makes it a great option for new investors. Other things that make Charles Schwab beginner-friendly are safety, mobile and web trading platform, great customer service, low costs, and ease of opening the account.

Q: Does Bank of America own Charles Schwab?

A: Charles Schwab was once a subsidiary of the Bank of America in 1983. However, the founder bought the company back and after a few months, he made it public.

Q: Do they provide any bonus for a new client?

A: Yes, Charles Schwab provides a bonus award of $100-$500 if you are referred by an existing client and you open and fund your account.

Q: What is the minimum deposit amount for Charles Schwab?

A: Charles Schwab doesn’t require a minimum deposit. Therefore, you can invest or trade with a smaller amount. This makes it a great option if you want to get started with your investment journey. You can add more money to the account with time as you get experience on how to manage your investment.

Q: What are some of Charles Schwab’s alternatives?

A: There are plenty of Charles Schwab alternatives. This means that they provide the same products like options, stocks, and CFDs among others. They also deal with similar types of clients like beginners, day traders, and experienced investors. Some of the alternatives include Firstrade, E*TRADE, Fidelity, and Merrill Edge. Others are Interactive Brokers, Trade Ideas, TradingView, Finviz, Motley Fool, and forextradersuk just to mention a few.

CLICK HERE TO GET INTERACTIVE BROKERS AT A DISCOUNTED PRICE!

CLICK HERE TO GET TRADE IDEAS AT A DISCOUNTED PRICE!

CLICK HERE TO GET TRADEVIEW AT A DISCOUNTED PRICE!

CLICK HERE TO GET FINVIZ AT A DISCOUNTED PRICE!

CLICK HERE TO GET MOTLEY FOOL AT A DISCOUNTED PRICE!

The post Detailed Charles Schwab Review: Important Notes For 2021! appeared first on Dumb Little Man.

0 Commentaires