You’re in a hurry and need to make a quick decision, you have a list of stocks that you want to invest in but the only problem is that they all seem too high risk for your liking. What do you do? Relax!

That’s what we’re here for.

In this blog post, we’ll be going over some guidelines on how to find low float stocks which are much more suitable for traders who don’t like taking risks with their investments.

So keep reading if you want to learn about our secrets!

Guideline For Low Float Stocks

What is low float stock?

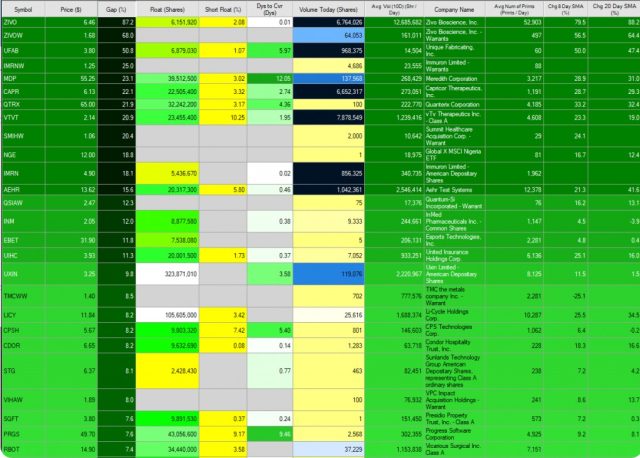

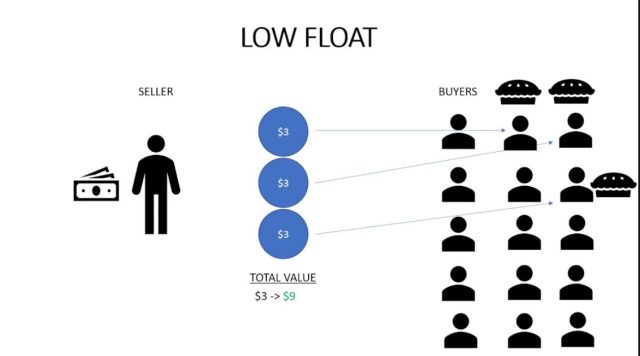

Low float stocks are considered to be a number of shares that have a lower supply of shares floating in the wall street market.

Therefore making them ideal for traders who don’t like taking risks.

The reason why they’re not too popular among other insiders/traders is that they can easily experience dramatic sell price spikes and price drops.

It is due to it also being very easy for large day traders to manipulate the price through passive public trading on trading day.

You will get a Floating stock by subtracting restricted stocks ad closely held stocks from a firm’s total outstanding shares.

How To Find Low Float Stocks?

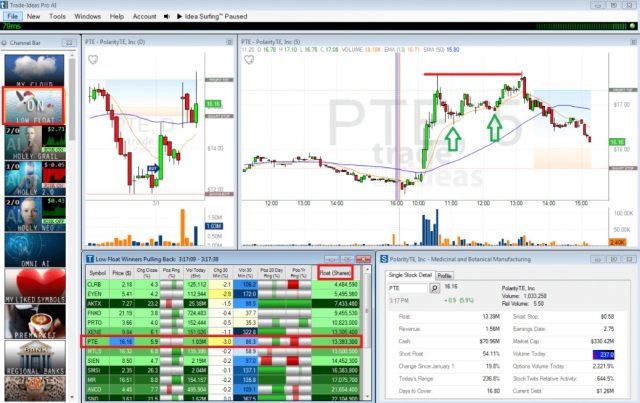

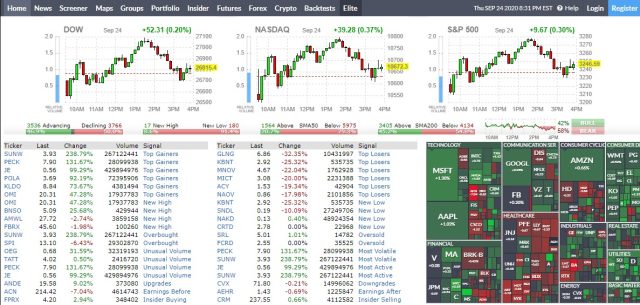

There are multiple ways to find low float stocks on your watch list including but not limited to Trade Ideas, Finviz, yahoo finance, etc.

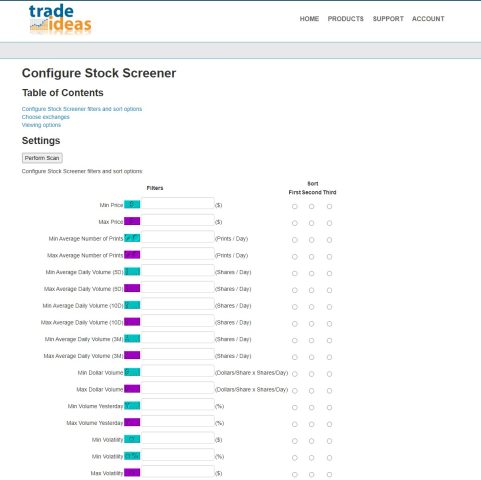

If you already know which company you’d like to invest in, Trade Ideas is a great place for traders for informational purposes on the daily public trading volume of their potential investments.

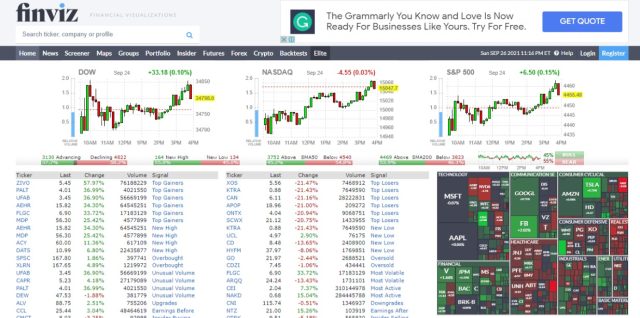

Finviz can also be helpful when it comes to sorting through organizations based on their P/E ratios or any other important data that may influence your financial decisions.

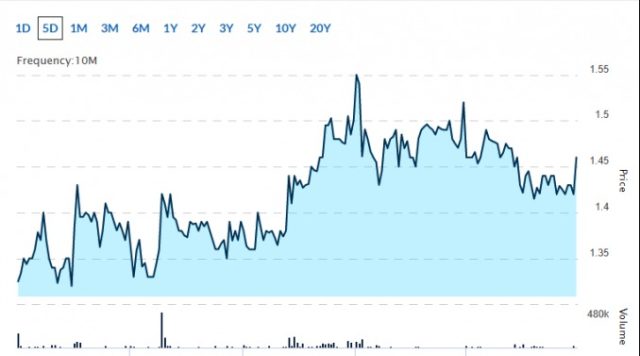

Yahoo finance will only show day traders the daily numbers for each specific stock if you’re usually looking at investment opportunities in larger time frames (i.e months).

CLICK HERE TO READ MORE ABOUT TRADE IDEAS

CLICK HERE TO READ MORE ABOUT FINVIZ

CLICK HERE TO READ MORE ABOUT YAHOO FINANCE

How To Trade Low Float Stock?

There’s actually no fixed way of trading in such stocks since there are so many variables that come into play when making your final decision.

If you’re primarily using TradeIdeas to sort through organizations, then all you have to do is simply look at the TradeSuggestion boxes for each stock and see if they meet your own investing criteria or not.

For informational purposes, the TradeSuggestions box will tell traders about the daily trading volume of a specific owned entity.

It also tells P/E Ratio, EPS investment, price, etc.

This can help you quickly assess whether or not the entity is worth investing in by looking at multiple investment statistics instead of just one number.

Why Invest In Low Float Penny Stocks?

The low float stock industry is a complex one that most day traders don’t even know about.

By trading in low float penny stocks, you can expect to see large returns if all goes well and the company is successful in its plans of expansion and/or taking over the market share from other competitors in share markets.

However, it’s important to remember that there are always risks involved when public trading anything online.

The Risk Of Investing In Low Float Stock

Day traders should always consider all possibilities when it comes to trading in low float stocks, especially if you don’t like high volatility.

The relative volume for day trading is so low for these organizations.

Hence, it’s very easy for large day traders and major stakeholders to manipulate their price through passive day trading.

This might result in negative consequences for you as an investor (i.e. the stock price dropping for an unknown reason).

Where Can I Invest My Money Into Low Float Stocks?

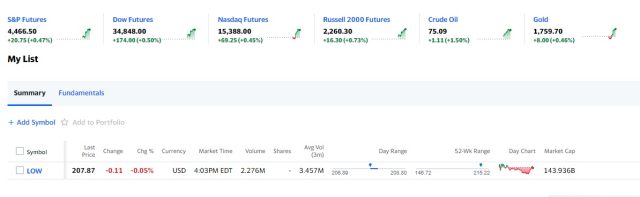

Trade Ideas is a great place to invest in low float stocks.

Since it allows traders to filter through more than a thousand shares on daily Trade Suggestions based on certain criteria such as P/E ratio, increased volatility, past performance, etc.

Trade Ideas also offers free real-time data.

It includes advanced charts and price analysis for each specific company.

You can utilize that data in order to make better financial decisions when trading in increased level low float stocks.

Best Practices For Investors With Low Float Stocks

-Only Invest What You Can Afford To Lose

Only trade low float stocks if you can afford to lose your investment and remember there’s always the chance of losing money whenever you invest in the share markets like Nasdaq.

If you can’t afford to lose money, then it’s probably best to avoid trading in low float penny stocks.

It’s better since there are no guarantees when it comes to investing in general.

-Know What You’re Investing In

Do your research on organizations before trading in low float penny stocks.

It’s not enough to just know the name of the company.

When it comes to making financial decisions, you need to understand their business model and how they plan on staying profitable once their stock prices go up (which is usually never).

-Be Patient With The Low Float Companies You Invest In

Never buy or sell in all at once especially if you’re dealing with low float penny stocks.

Make sure you leave yourself time in order to make adjustments when needed which in return will help you avoid any losses in the future.

The stock market like Nasdaq can be very unpredictable, but if you keep doing your due diligence in financial markets then you should have no problem avoiding potential pitfalls that may come your way.

As long as you’ve done everything correctly and have a solid strategy in place, you shouldn’t have to worry about anything going wrong so just be patient with your investments.

-Be On The Look Out For Red Flags

Since low float stock’s relative volume is less often compared to higher volume companies while day trading, there’s a chance that something could be hidden from the public eye which usually results in an increased risk for traders.

Make sure you do everything possible in order to avoid these risks since they’re not worth it especially if you want a more stable portfolio without having to worry about any surprises.

Always look out for red flags while trading in low float penny stocks and make sure the company isn’t involved in some sort of scandal before making a major financial decision one way or another.

Trade Ideas has multiple filters and alerts you can use in order to stay up-to-date with what’s going on with all our companies which is extremely important when it comes to investing in low float stocks.

The best way to learn about low float stocks is by investing in them. Trade Ideas has the right tools, knowledge, and expertise you need for your investment needs.

Conclusion

The key takeaways from this guideline on low float stocks are that investing in low float stocks can be very exciting, but as always there are risks involved so you should only invest your hard-earned money if think you’re capable of handling any potential losses that might come your way.

As long as you follow the guidelines listed above and use Trade Ideas to invest in low float stocks then you should have no problem avoiding major issues while potentially earning large returns if everything goes according to plan.

CLICK HERE TO GET TRADE IDEAS AT A DISCOUNTED PRICE

F.A.Q.

What Does Low Float Mean In Stocks?

A stock has a high float when there are many publicly tradable available shares for purchase or sale on the financial market/markets.

A low float indicates that there are few public shares available and usually reflects a company about to go public, a thinly traded stock where trading software is dominated by large institutional investors and/or restricted share classes which limit the free flow of capital in and out of the securities.

Low float stocks have a low number of shares.

You will get a Floating stock by subtracting restricted stocks and closely held stocks from a firm’s total outstanding shares.

Because finding a buyer/seller is more difficult to buy or sell, stocks with a small number float will usually have higher volatility.

How To Find Low Float Stocks?

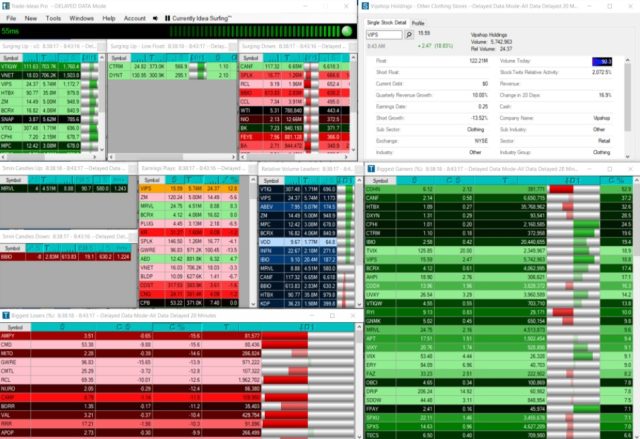

The best way to screen for low float stocks is with an online screener.

You have two options: either go through all the over 10,000 U.S. equity securities using third-party databases like Finviz (free) or use your broker’s proprietary screener (usually paid).

The latter methods are easier if you already know how to search for low float stocks on your broker’s screener.

An alternative method, if you have access to Barchart.com or Yahoo! Finance, is to input the symbol in the upper right corner and hit “Get Screens”.

How To Find Low Float Stocks On Finviz?

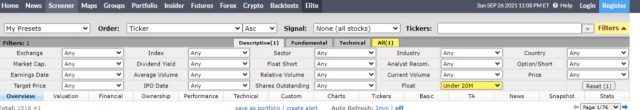

First, go to finviz.com and click the screener box at the center top of the page.

Then fill in the filters given( put float values under 20 million) and you will get the float values for different entities.

You’ll find a list of low float stocks also known as “tight floats”.

Click on an individual stock for more details including charts, news catalysts, etc.

CLICK HERE TO GET FINVIZ AT A DISCOUNTED PRICE

How To Trade Low Float Stocks?

Trading low-float stocks like Chicago rivet can be extremely risky as it is difficult to predict short term supply and demand swings in such thinly traded stocks.

It means they may gap up or fall down on any given day due to large trades happening at odd times during the day when there are few buyers or sellers on the other side.

Most day traders who are new to trading low-float stocks end up getting washed out of their positions because they cannot handle the volatility.

It is best to limit your exposure on any one position and use tight stop losses when trading low float stocks due to their high volatility.

It takes a lot of time and experience before you can be successful at trading publicly traded companies with low floats.

You must develop an understanding of how these stocks move, learn about upcoming catalysts that may affect supply/demand dynamics, practice placing trades in simulation mode first before executing real trades, patiently wait for the right setup before entering a trade, have strict exit rules e.g. never hold a stock overnight, use tight stop losses to limit your downside, etc.

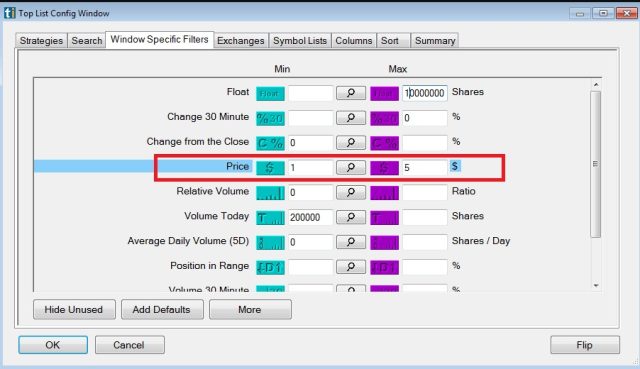

How To Find Low Float Stocks On Thinkorswim?

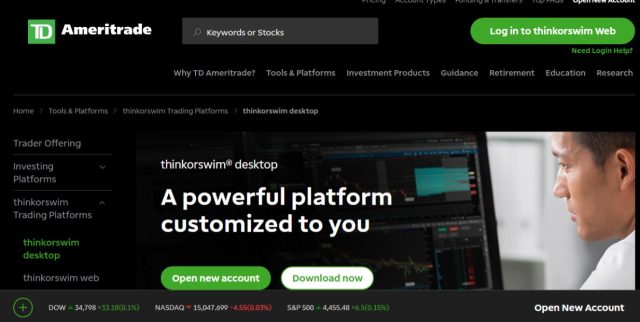

Thinkorswim does not currently have a built-in Low Float Stock Scan. So you will have to look for other options like TradeIdeas, Chartink, etc. Once you have found low float stock via these options you could use Thinkorswim for further analysis.

CLICK HERE TO GET TRADE IDEAS AT A DISCOUNTED PRICE

The post Low Float Stocks: The Guideline That You Won`t Be Lost With appeared first on Dumb Little Man.

0 Commentaires