Thinkorswim platform with TD Ameritrade mainly because its charts and tools are top-notch and simple to use for both experienced and inexperienced traders for trading options.

Thinkorswim, a service of the American brokerage firm TD Ameritrade, is widely considered as one of the greatest trading systems in the world throughout Canada, Hong Kong, Japan, European Union countries in local laws and regulations, and so on.

StockBrokers.com placed TD Ameritrade first in trading software and tools due to its sophisticated platform.

TD Ameritrade has great market volatility, volume, and system availability in options trading subject.

Thinkorswim’s extensive features and innovative functions in market volatility, volume, and system availability, such as stock screeners, assist customers in resolving one of the most prevalent issues: locating an all-in-one solution that integrates everything required to trade effortlessly with one strong stock research program.

However, they may expose investors to delay account access and trade executions as special risks inherent also. A security’s or strategy’s and delay account access and trade executions in past performance are no guarantee of future outcomes or investment success.

Relevant risk factors in these special risks inherent could expose investors to these drawbacks so they need to consider it carefully.

The next post will teach you about using Thinkorswim platform in a way that will allow you to fully utilize the trading platform’s capabilities in many options trading.

This Thinkorswim review includes Thinkorswim tutorial information on the app’s features, trading products, fees, research and education tools, and other fascinating facts and observations.

There are some other useful hints for expert traders, focusing on features and research tools provided by Thinkorswim platform, the good one in options trading.

Here is The Full Thinkorswim Tutorial

What Exactly Is Thinkorswim?

Thinkorswim, like TC2000, eSignal, and NinjaTrader options trading, is downloaded software that must be installed locally trading options. However, before you can utilize the program, you must first open an account with the broker.

The self-directed account setup process is simple and quick since the customer care team is really helpful and responsive.

After your registration has been confirmed and the software has been installed, you may quickly log in using only your username and password.

The basic layout includes a left-hand column of windows that perform various duties trading tools.

A wishlist, a graph, a computer monitor, a media window, and account statistics are all available.

The primary menu is located at the top of the platform. Popular options include scan, trading, charting, and education trading tools.

A plus (+) sign may be seen in the bottom left sidebar area of Thinkorswim.

When you tap on it, you’ll be presented with a list of alternative windows that may be added to the application.

Popular options include a currency map, a Level II window, and time and sales statistics.

There are a few video games as well.

Thinkorswim allows you to trade a broad variety of assets.

ETFs, closed-end funds, stocks, options, futures, and FX are examples of these.

CLICK HERE TO READ MORE ABOUT THINKORSWIM

Thinkorswim Platform Useful Tools That You Can Use

This article referring to the Thinkorswim scripting language “thinkScript,” which allows traders to design their own indicators.

It comes with 300 built-in studies and techniques that users may apply to their best plays.

Many stages can, in fact, be automated using Thinkorswim.

The Strategy Roller, for instance, allows options traders to automate the construction of a bespoke rolling strategy for any covered call position from one end date to the next based on the user’s specified parameters.

Stocks and options are filtered using customizable scanning and screening methods.

The Stock Hacker tool will search for stocks that match your criteria and provide you notifications.

The Option Hacker tool operates in the same way for options.

Spread Hacker assists traders in searching for spreads, while Spread Book displays all orders placed by Thinkorswim users, but they stay anonymous.

Thinkorswim offers a mobile version available for both iOS and Android users.

Unlike other trading applications, Thinkorswim Mobile has many of the same features and capabilities as its windows desktop. It can even be synced with your PC.

Thinkorswim trading platform working space is separated into two sections: a sidebar on the left and a primary window in the Thinkorswim learning center of your trade stations.

The sidebar provides subtabs with pertinent information.

It is configurable, and the user may add various gadgets, such as account data tabs, a messaging center, and a calculator, as well as a wishlist and stream capabilities, as well as fast charts and potentially rapid and substantial losses quotations in the future results.

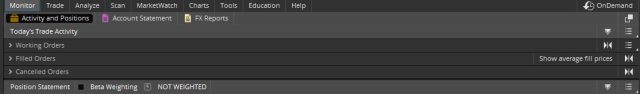

In contrast, the main window has the following tabs:

- Monitor: This is the tab where you may keep track of your trading activities (order, statement, monetary base, and open positions).

- Trade: Learn more about the tradable items available on the site (each category has its own interface).

- Evaluate: This tab lets you backtest and analyze actual and hypothetical trading scenarios, as well as delve further into economic databases, volatility and probability analysis, and so on.

- Scan: Here you may filter among stocks, options, foreign exchange, and futures to see which of the available instruments meet your criteria.

- MarketWatch: This page provides in-depth market data (quotes, alerts, rates, calendars, and so on) as well as handy tools to help you digest it.

- Charts: This is the interface for the Thinkorswim platform’s sophisticated charting tools (you may play with actual statistics and chart patterns).

- Tools: This tab covers the remainder of the Thinkorswim features, such as myTrade, TradeFeeds, thinkLog, and others.

- Education: Everything you need to know about the platform’s functionality, as well as key instructional resources about financial markets and trading, may be found here.

- Help: Tap here for helpful instructions on navigating the site and finding what you’re looking for.

Accessing the bars on the windows taskbar, along with all of the subtabs, might appear to be rather difficult for first-time users with no prior trading expertise.

Nevertheless, after few sessions, users generally become acquainted with the strong platform and begin to feel at ease with it.

Paper Trading Platform On ThinkorSwim Is For Practice

Traders may test their ideas without risking any real money by utilizing Thinkorswim’s Paper Money trading account.

It is accessible in both desktop and mobile versions, and it is a great tool to employ in conjunction with backtesting to fine-tune one’s trading strategy.

Take our TOS Course for extra assistance in getting your platform up and running.

You will be immediately enrolled for the paper money account if you open a TD Ameritrade account. Otherwise, you may sign up for a free 60-day trial.

Thinkorswim includes a plethora of other features and tools.

It features social media groups and forums for traders to interact and discuss techniques, such as myTrade.

The TD Ameritrade Review Evaluation

A Thinkorswim review would be incomplete if it did not include information on TD Ameritrade Inc, as the two are merged as one.

The brokerage business offers a wide range of account kinds to meet almost any and all needs of financial markets.

Traders can fill their financial markets accounts using a money transfer, a cheque, an ACH (online bank deposit), an external equities transfer, or regular inventory certificates and supporting documentation.

(It should be noted that ACH funding has a transfer limit of $50-$250,000, that is not the case with other funding choices.)

There is also no minimum amount necessary to create an account, but if you want to play with margin on options or futures, you’ll need at least $1,000 to do so for stock prices.

For individuals subject to the PDT regulation, cash accounts are ideal. Because options settle overnight, I trade them in a cash account (T1 rule).

CLICK HERE TO READ MORE ABOUT THINKORSWIM

Thinkorswim’s Trading Features

If it refers to Thinkorswim learning center, it is fair to state that the platform provides one of the most comprehensive financial services on the market.

Thinkorswim trading station has so much to offer that even the most seasoned traders will not be dissatisfied.

One of the primary advantages of the platform is the ability to access Federal Reserve Economic Data and receive regular updates for free.

Thus, along with the ability to mix numerous fundamental and technical indicators (there are over 400 technical indicators available for expert charting), provides a whole new level of experience.

Rich backtesting capabilities, configurable alerts, sentiment scores, and automated trade are available to more demanding traders.

Nevertheless, what truly distinguishes Thinkorswim from its competitors is the broad range of technical studies available – more often than any other options trades.

Even those technical indicators who wish to further personalize the advanced platform and its capabilities by developing their own methods will find plenty to like about Thinkorswim.

If technical indicators want to trade using a proprietary trading strategy, use Thinkorswim in thinkScript function – a proprietary scripting language that allows you to transfer your trading approach into the platform – is available.

Also when they use Thinkorswim, technical indicators can see how TOS platform can limit order in a market order with advanced charting which helps people who gain access and use Thinkorswim can be experts.

Markets For Exchangeable Goods

Use Thinkorswim, you may trade a wide range of products, including stocks, bonds, mutual funds, ETFs, options, risk management, futures (including options on futures), limit order, market order, and foreign exchange in the market conditions.

One of the finest features of the advanced platform of the site is the availability of more than 300 commission-free ETFs.

As a result, investors may trade quickly without having to pay exorbitant commission fees. Aside from ETFs, you may also trade select mutual funds for free.

The ThinkorSwim Account Subscriptions Cost

In a word, the broker provides one of the market’s most competitive pricing structures.

Add to it the fact that TD Ameritrade has no account minimum requirement, and you can see why it is regarded as one of the finest options for investors with less cash.

But let’s return to Thinkorswim and see why the platform truly stands out in terms of cost.

Aside from being free, Thinkorswim gives free access to Federal Reserve Economic Data, which you may use even if you haven’t funded your membership.

Keep in mind the only other method to access this information is to purchase a Bloomberg Terminal, which charges more than $2000 per month.

– There is no charge to establish a ThinkorSwim account. Only your deposit of funds

– A modest deposit may be required to add real-time data to your simulated account

– $0 commissions for US exchange stocks and ETFs

– $0.65 for each options contract

– Mutual Funds – no commission charge

– Futures are $2.25 per contract plus exchange and regulatory expenses Pricey.

– Forex Has no fees, but the spread reflects the cost of the deal.

-Level 2 data is provided

-Third-party research reports.

– There is no minimum deposit necessary to start an account.

The rate for stocks and ETFS is now zero. For more information on pricing, fees, margin, and interest rates, visit TD Ameritrade (find out how to open an investment account).

Because of the intense competition for free trading from new brokers, TD had to reduce its costs for 2020.

TD Ameritrade has a lot to offer to make it appealing to traders on a tight budget.

Broker wars are beneficial to consumers as long as service is not jeopardized.

CLICK HERE TO READ MORE ABOUT THINKORSWIM

Is Thinkorswim Free To Use?

ThinkorSwim (TOS) is a no-cost trading platform.

You only need to finance your account.

You may also use their simulated trading account.

Simply call and they will convert your paper trading simulation data to real-time data, however, you may be required to make a modest payment into your account.

But it’s well worth it. As a trader or investor, you will never regret having this instrument.

They just offer superior features that outperform every broker in the business ON THE WHOLE.

The Thinkorswim software has so many useful tools that it might be overwhelming for a new trader.

The Cons Of The TOS

There are a few drawbacks, but they are small.

Order executions might lag at times, so be cautious when trading low-float equities with Thinkorswim.

They are not the fastest at executing orders, but they are adequate.

TD does not seem to have the greatest shorting location.

If you want to short mid and small caps, there are better brokers available right now.

Because TD requires a lot of margin for futures, you’re better off using Ninjatrader if you’re short on cash.

However, you may still trade micros with a tiny account.

Another impediment to considering is the merging of TD and Schwab.

Who Is The Target Of ThinkorSwim?

The comprehensive instructional materials and free market data, as well as the rich features and range of commission-free products, making it an excellent alternative for all sorts of traders.

The platform’s versatility and the fact that it allows for extensive customization based on the person’s trading strategy and philosophy make it a user-friendly, highly functional, and simple-to-navigate solution.

CLICK HERE TO READ MORE ABOUT THINKORSWIM

Best Alternative Service Mark

Trade Ideas Stock Market

Trade Ideas is one of the other options trading well-known intraday stock advanced platform trading scanner that offers real-time data from trading platforms and ETF movements with trading strategies and investment advice.

With a versatile, this one of configurable best trading platforms driven by an artificial intelligence (AI) robo-advisor, Holly, the program links to numerous level 2 online brokerages for online brokers.

Trade Concepts Described

Trade Ideas was created in 2003 by a group of FinTech entrepreneurs to assist investors and intra-day traders in catching stocks in real-time.

Stock market scanners manage a vast quantity of data and filter out stocks worth monitoring on a daily basis.

Trade Ideas is a web-based program tool that gives profit possibilities and stock market ideas.

Perfect for day trading beginners.

Trade Ideas offers sophisticated trading software that assists traders, traders, and investment managers with certified financial advisors in effectively scanning the stock exchange for trends, changes of direction, and execution indications.

It monitors every stock trade during the day and alerts the user in real-time to potential setups based on your which was before filtering criteria.

What distinguishes Trade Ideas is its extensive collection of fundamental or technical criteria, such as market cap and EPS.

It also conducts event trigger settings so that you may be the first to take advantage of the chance.

Trade Ideas solves one of the most difficult problems in stock trading: investors used to have to manually filter through a vast amount of market data to discover profitable chances and perform them quickly.

How Does It Work?

The program employs an AI-powered robo-adviser system comprised of various investing algorithms.

It then runs a million trading situations night to identify a subset of market relationships with the best likelihood of predicting the outcome, which it then utilizes to advise about which events, longs, and shorts qualify.

Then, consumers may choose to monitor the AI’s performance or to participate in the transactions at their own risk.

Holly, named after the Holy Grail, is the AI adviser that serves as the Trade Ideas investment discovery engine.

Holly divides strategies into over 35 ideas after every trading day and analyzes technical and perceived loudness statistics, longs, shorts, fundamentals, and more.

The advisor’s monthly performance is reported on the Trade Ideas website.

Users have access to three distinct ‘Hollys’:

Holly is a formalized paraphrase (Holly Grail)

Holly Version 2.0

Holly Neo Trade Ideas also has a number of other features and tools to improve the user experience.

Plus Brokerage

Clients with Interactive Brokers accounts may use this tool to construct scans, establish trading strategies, and execute electronic trading orders.

You may also choose a semi-automatic approach, in which you actively put entries, giving you more control.

Having said that, Trade Ideas has already been known to limit the amount of Brokerage Plus licenses available. For example, in the first quarter of 2019, licenses were limited to 1,000.

Simulated Paper Trading Account for Free

Trade Ideas offers a free trial account for Brokerage Plus before creating an account.

The virtual paper financial plan allows you to test out Interactive Brokers’ sophisticated platform without committing to anything.

Costs and account values are based on real-time market circumstances, including actual trading fees, commissions, and spreads.

Window For The OddsMaker

Premium users may use OddsMaker to backtest methods by grading scans, points of entry, escape routes, and trading plans against recent historical data.

This aids in the visualization of investing techniques by estimating the likelihood of success and recommending ways to enhance your plan by progressively optimizing parameters.

Windows for Charts

Rather than using different platforms for research and alerts, the Chart Windows feature allows users to confirm an alert without leaving the Trade Ideas Pro site.

Based on the membership package, users can view 10-20 chart windows and add price alerts straight to selected charts.

Nevertheless, when compared to a specialist charting tool like TradingView, consumers should not anticipate a large variety of chart indicators.

Instead, they should just utilize this tool to research stocks.

The News

Under the ‘Single Stock Window’ tab, Trade Ideas Pro customers may receive relevant stock news items with a single click, however, this tool functions more as a market scanner than a specialized newsfeed for other financial markets.

So, although Trade Ideas does not replace news broadcasts and analysis platforms like Benzinga Pro when it comes to FX and cryptos, it is still a useful tool for rapidly understanding why a company is performing well or poorly.

You can also join up for a free ‘trade of the week’ newsletter to receive additional information.

Chat Room in Real Time

Even if they do not have a Trade Ideas membership, customers may log into the live trader’s chat room to communicate with the support team and trading community.

The supervised panel discussion can offer additional suggestions, perspectives, and, in some cases, a live walkthrough of investment prospects.

Each day, the data from each chat session, including messages and notifications, is removed, although session recordings are available on the Trade Ideas Video platform.

Prices

Members of Trade Ideas can select between two account levels, each with its unique price structure.

Both choices may be paid for monthly or annually, with the latter offering up to $468 in savings.

Trade Ideas occasionally provides promotional coupon savings as well.

Account Standard

The Standard Plan would cost $1,068 each year or $118 per month and provides customers with the following benefits:

- Trading room in real-time

- Price alerts can be set up to 500 times.

- Ten concurrent charts

- Simulated trading in real-time

- Streaming trading ideas in real-time

- Visual trade helper based on charts

- The channel bar (Curated Workspaces by Trade Ideas)

Premium

The Premium Plan costs $2,268 per year or $228 per month and includes, in addition to the Standard Plan benefits, the following:

- Scanner for reversals

- Risk evaluations

- Signals for entry and exit

- 20 charts are displayed concurrently.

- Chart-based AI Trade Assistance Strategy Development and Testing Service

- Pro Trade Ideas Holly, an A.I. Virtual Trading Analyst

The Benefits of Trade Ideas

- A wealth of instructional tools are available, including webinars, user manuals, and personal training sessions.

- A powerful stocks scanner with various built-in configurations.

- A free simulated trial trading account is available.

- Compatible with well-known brokers

- Live chat room for free

- AI robo-advisor for automated system.

CLICK HERE TO READ MORE ABOUT TRADE IDEAS

Conclusion

Thinkorswim is TD Ameritrade’s main platform, and it includes a wealth of advanced charting tools, customization options, market order and much more.

Some traders really satisfied with the platform’s quality and dependability; nevertheless, there is a learning experience since there is a lot to learn about that now.

Nevertheless, there are some drawbacks to use Thinkorswim platform that need to tackle trading strives such as it is tough to learn software, and also other video feeds, such as Bloomberg and Tastytrade, are missing.

There are no certified financial advisors in this trading station so traders should consider their investment decision carefully.

The program is sluggish to load, and the option tools are not at all user-friendly.

There are no profit-and-loss graphs.

Besides, if you are a newcomer, you could try out such offer Trade Ideas as another great option trades instead with this system availability of trade stocks.

Today, Trade Ideas offers a sophisticated stock scanner tool to active traders, especially day trading beginners.

It is regarded as the market’s best screener due to its numerous features, instructional help, and broker compatibility.

Whereas a free alternative is available, it lacks superior statistical forecasting capabilities, an artificially intelligent engine, automatic trade, and a free live chat room.

CLICK HERE TO GET TRADE IDEAS AT A DISCOUNTED PRICE

F.A.Q.

How To Use Thinkorswim?

According to TD Ameritrade that whenever it comes to trading tools, Thinkorswim is not really your ordinary Joe system. And it combines revolutionary technology and trimming features.

And, in truth, it does. In a word, use Thinkorswim is a good platform available on the market right now.

Rather than utilizing TD Ameritrade’s Thinkorswim software, day trade newbies could check at Interactive Brokers’ free paper trade module and Trade-Ideas A.I. Pro, the best stock screener on the globe.

The best trading platforms stock prescreening for day traders is Trade Ideas. They also include a free newspaper trade account and a free trade chat room.

How To Use Thinkorswim For Free?

Thinkorswim is available to all TD Ameritrade brokerage clients at no cost so you can use it without payment so you can help it gain access in this free section of platform.

On Thinkorswim, you can do paper trading for free also.

How To Use Thinkorswim Paper Money?

Thinkorswim mobile is one trading platform that allows for paper trading.

Thinkorswim has a solid name in the industry as one of the top electronic trading systems, so it’s a good place to start when it comes to your trading pursuits.

On Thinkorswim, it is quite simple to get started with paper trading.

If you already have a TD Ameritrade profile, you will be automatically enrolled in their paperMoney option, allowing you to practice dealing immediately.

So all you’d have to do is sign in and download the program.

Do not really stress if you don’t have a TD Ameritrade account; you can still practice paper trading.

You will just need to register, which involves entering your information to create your paperMoney account.

It is not a difficult process, so you’d be able to get started right away.

How To Use Thinkorswim Charts?

Because we have the charts tab selected, the charts appear.

Each chart has a little box in the center.

These are present because flex grid editing is enabled.

This small box allows you to add and delete charts from the flex grid.

To get there, tap the nine-dot symbol in the top right corner of the app and then pick “customize grid.”

To insert exponential moving and drawings to a grid, right-click on any grid and choose Style, Drawings, or Studies.

You may also access the same icons from the grid’s top menu.

Each grid has a “D” symbol at the top that allows you to rapidly alter the grid’s timescale.

Every grid is self-contained. Grids, and even watchlists, can be linked to grids.

Click the chain icon next to the symbol box in the upper left corner of a grid to link anything.

Choose a color that is the same as the color of your watchlist (maybe red).

Once you tap a watchlist symbol/stock, the grid will be filled with that stock. This allows you to connect two grids for numerous time periods or research.

How To Use Active Trader In Thinkorswim?

The Active Trader section is a Thinkorswim interface created specifically for upcoming traders, who may take advantage of its convenient offer price ladder, one-click order entry, and high degree of customization.

On the Trade tab, click Active Trader to access this interface.

When the interface is first accessed, it will display two similar sets of gadgets: Chart + Active Trader. Big Buttons and AT Ladder make up the Active Trader.

A device control bar to the right of each set allows you to add or delete gadgets by clicking on the relevant buttons: Trade, Times and Sales, Active Trader, Chart1, Chart2, Chart3, Dashboard, Level II, and Live News.

It’s also worth noting that you may utilize one among predetermined layouts by selecting (Grid presets) at the top. To adjust the number of gadget sets on the whole Active Trader grid, click (Grid) in the top right corner.

CLICK HERE TO GET TRADE IDEAS AT A DISCOUNTED PRICE

The post Thinkorswim Tutorial: Best Guide Ever [2021]! appeared first on Dumb Little Man.

0 Commentaires